Games industry mergers and acquisitions in Q1 of 2025 rose to $6.6 billion, their highest level in over a year, driven by activity in the mobile sector.

That big number was partly down to Scopely’s $3.5 billion acquisition of Niantic’s games business, including the likes of Pokémon GO.

That’s according to a newsletter by gaming-focused investment bank Aream, made in partnership with InvestGame. This previous quarter was the highest for mergers and acquisitions since Q4 of 2023, when Microsoft completed its purchase of Activision Blizzard.

It’s worth noting that the report delineates between completed mergers and acquisitions and those that have been announced. Here’s a graph documenting recent M&A trends from the report:

Other key deals made in that timeframe include Miniclip’s $1.2 billion purchase of Easybrain, and AppLovin divesting its mobile gaming arm for $900 million as it focuses its business on mobile advertising.

The Q1 numbers also include Take-Two’s $460 million acquisition of Borderlands developer Gearbox Entertainment.

The report points out that overall activity exceeds pre-pandemic levels. This most recent wave of deals is motivated by “strategics taking a more active role in reshaping their portfolios” and a “select group of private consolidators pursuing acquisitions and growing private-equity interest in the space.”

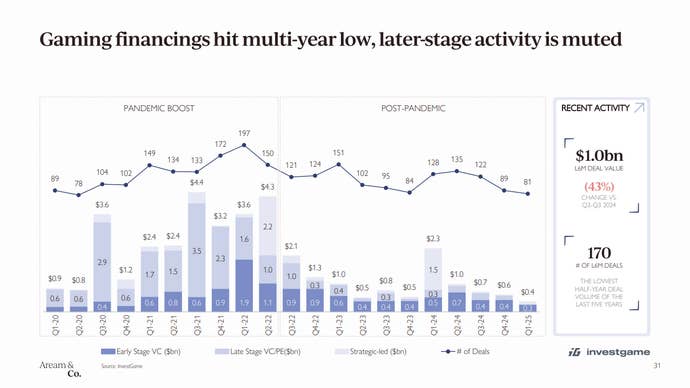

Elsewhere, the report points out that private financing remains challenging in games, “particularly in late stage rounds”, with this quarter the lowest in years:

There’s a similar trend curve for early-stage private investment, particularly Series A funding.

The full newsletter has more insights on the state of the industry at large.